The MCAT and CPA Exam are among the most commonly taken examinations worldwide.

However, these two exams significantly differ from each other. Prior to taking either the MCAT or the CPA, you must make sure that it is the correct exam for your chosen career path.

The MCAT is the top entrance exam used by top-tier medical schools, colleges, and other educational institutions worldwide that offer medical courses.

On the contrary, the CPA Exam is a licensure test that needs to be taken by every accountancy graduate for them to be a Certified Public Accountant (CPA).

And to help you learn more about the difference between these two exams, – this article will go through the different exam structures, exam fees, and other characteristics of the MCAT and CPA Exam.

We will give a comprehensive comparison between the MCAT and CPA Exams.

What is the MCAT?

MCAT, or The Medical College Admission Test, is an admission test that will determine the readiness of students to enter medical school. The exam is intended for those who wish to pursue a medical profession.

It is a 7-hour-long exam which is conducted by the Association of American Medical Colleges (AAMC).

This computerized test, comprised of four test sections, is primarily part of the admission process in any medical school available in the following countries the USA, Canada, Australia, and other countries worldwide.

Also, MCAT tests different sciences and basic science concepts, which include General Chemistry, Organic Chemistry, General Biology, Biochemistry, Physics, Psychology, and Sociology.

Aside from these, the exam tests one's abilities, content knowledge, critical analysis, and reasoning skills. It contains 230 multiple-choice test questions and is considered very challenging and the most difficult exam for a graduate school.

The MCAT is also offered 35 times a year, thus making the exam more accessible to its test-takers worldwide.

What is CPA Exam?

To become a licensed Certified Public Accountant (CPA), you need to take a licensure exam called the Uniform Certified Public Accountant (CPA).

This licensure exam is developed by the American Institute of Certified Public Accountants (AICPA). And it is administered by the National Association of State Boards of Accountancy (NASBA).

Also, it is a computerized test with a duration of 16 hours and it contains four test sections.

Each of the test sections are divided into subtest which are referred to as Areas I, Areas II, Areas III, Areas IV, and so on.

As for the type of questions, the CPA exam utilizes three formats which are the multiple-choice test format, task-based simulations and BEC written communications.

And it contains a total of 302 test questions.

The CPA Exam main objective is to measure the knowledge, skills, and abilities of its test-takers if they are prepared to practice public accountancy. It will also determined if they are worthy to have the license for the said profession.

The Four CPA Exam Test Sections are:

MCAT vs. CPA Exam: What are the Similarities?

The MCAT and CPA Exam are both computerized examinations.

Also, these tests primary purpose is to test the content knowledge, skills, and abilities of its test-takers in relation to the different subjects and topics covered by each exams.

Also, the MCAT and CPA Exam are among the two most difficult exams that are trusted and highly acknowledged by educational institutions.

Exam Format and Structure: MCAT vs. CPA Exam

These exams do not share the same format and structure as they do not focus on the same profession.

The MCAT is used as an entrance exam for medical schools, while the CPA Exam is a licensure examination for accountants.

However, if we compare the two in terms of their exam duration, the CPA Exam is much longer. This exam usually takes about 16 hours for an individual to complete in one sitting. Contrastingly, the MCAT only takes about 7 hours and 30 minutes to complete.

Both exams, contain four test sections but in the CPA Exam, each test sections are sub-divided into different areas.

For the number of test questions, the CPA Exam has 302 test questions in total while the MCAT has 230 test questions.

The MCAT and CPA Exam are both computer-based test making it more convenient to its test-takers.

And for the exam frequency, the MCAT has 35 test schedules annually while the CPA Exam is only offered four times a year per test section.

It means that you can take one test section at a time wherein a testing window is available annually.

The CPA Exam schedules are between January 1 to March 10, other test schedule is available between April 1 to June 10.

The next CPA Exam schedule is around July 1 to September 10 and October 1 to December 10.

The table below compares the MCAT and CPA exam structure and format, including their test frequency.

Exam Format and Structure | MCAT | CPA Exam |

|---|---|---|

Test Sections | Biological and Biochemical Foundations Chemical and Physical Foundations of Biological Systems Psychological, Social, and Biological Foundations of Behavior Critical Analysis and Reasoning Skills | Auditing and Attestation (AUD) -Area 1 - Ethics, Professional Responsibilities and General Principles -Area II - Assessing Risk and Developing a Planned Response -Area III - Performing Further Procedures and Obtaining Evidence -Area IV - Forming Conclusions and Reporting Business Environment and Concepts (BEC) -Area I - Corporate Governance -Area II - Economic Concepts and Analysis -Area III - Financial Management -Area IV - Information Technology -Area V - Operations Management Financial Accounting and Reporting (FAR) -Area I - Conceptual Framework, Standard-Setting and Financial Reporting -Area II - Select Financial Statement Accounts -Area III - Select Transactions -Area IV - State and Local Governments Regulation (REG) -Area I - Ethics, Professional Responsibilities and Federal Tax Procedures -Area II - Business Law -Area III - Federal Taxation of Property Transactions -Area IV - Federal Taxation of Individuals -Area V - Federal Taxation of Entities |

Test Duration | Duration per test section:

90 to 95 minutes each Overall: 7 hours and 33 minutes, including break times. | Duration per test section: 4 hours each Overall: 16 hours |

Number of Test Questions | 230 Test Questions | 307 Test Questions |

Type of Test Questions | Multiple-Choice Test Format | Multiple-Choice Test Format Task-Based Simulations BEC Written Communications |

Test Frequency | 35 testing dates annually from January to September. | Offered four times annually (Per Test Section) |

Test Delivery Mode | Computer-Based Test | Computer-Based Test |

Scoring: MCAT vs. CPA Exam

In terms of the scoring system, the MCAT and CPA Exam use different scoring processes. To start with, in the CPA Exam, each test section has a score range of 0 to 99 points.

And these points are not considered raw scores but these are the points corresponding to the number of test questions you answered correctly.

Furthermore, the scores you have across the four test sections will be calculated to get your CPA Exam scaled score.

The CPA Exam scaled scores are the weighted combination or percentages of scaled scores in each test section. It means that each of the scores has a corresponding value that equals the overall scaled scores.

In comparison, the MCAT has assigned scores in each of its test sections that range from 118 to 132 points. All the scores from the four test sections will be added to get the MCAT overall score between 472 to 528 points.

Also, MCAT utilizes a percentile rank that comprises scores from its previous test-takers. And this percentile rank can be used as a guide for its present examinees to know the percentile ranking of their scores.MCAT Scoring | CPA Exam Scoring |

|---|---|

Score Range Per Test Section: 118 to 132 Overall Score Range: 472 to 528 | Score Range Per Test Section: 0 to 99 |

The table below shows the CPA Exam passing score requirement.

CPA Exam Test Section | Score Range | Minimum Passing Score Required |

|---|---|---|

Auditing and Attestation (AUD) | 0 to 99 | 75 |

Business Environment and Concepts (BEC) | 0 to 99 | 75 |

Financial Accounting and Reporting (FAR) | 0 to 99 | 75 |

Regulation (REG) | 0 to 99 | 75 |

Below is the table showing the weighted portions or scores value of the CPA Exam sections.

Test Sections | Portion of MCQs (Multiple-choice Test Questions) | Portions of TBSs (Task-Based Simulations) | Portions of Written Communication Tasks | Total |

|---|---|---|---|---|

AUD | 50% | 50% | N/A | 100% |

BEC | 50% | 35% | 15% | 100% |

FAR | 50% | 50% | N/A | 100% |

REG | 50% | 50% | N/A | 100% |

Below is the table of the MCAT Percentile Rank from May 1, 2021, to April 30, 2022 MCAT exam. It is a comparison table showing the percentile ranking of your scores in correlation to the previous scores of MCAT test-takers.

Overall MCAT Score | Percentile Rank | Header | Overall MCAT Score | Percentile Rank | Header | Overall MCAT Score | Percentile Rank |

|---|---|---|---|---|---|---|---|

472 | <1% | Cell | 491 | 19% | Cell | 510 | 78% |

473 | <1% | Cell | 492 | 21% | Cell | 511 | 81% |

474 | <1% | Cell | 493 | 24% | Cell | 512 | 84% |

475 | <1% | Cell | 494 | 27% | Cell | 513 | 86% |

476 | 1% | Cell | 495 | 29% | Cell | 514 | 88% |

477 | 1% | Cell | 496 | 32% | Cell | 515 | 90% |

478 | 1% | Cell | 497 | 35% | Cell | 516 | 92% |

479 | 2% | Cell | 498 | 38% | Cell | 517 | 94% |

480 | 3% | Cell | 499 | 42% | Cell | 518 | 95% |

481 | 4% | Cell | 500 | 45% | Cell | 519 | 96% |

482 | 4% | Cell | 501 | 48% | Cell | 520 | 97% |

483 | 6% | Cell | 502 | 52% | Cell | 521 | 98% |

484 | 7% | Cell | 503 | 55% | Cell | 522 | 99% |

485 | 8% | Cell | 504 | 58% | Cell | 523 | 99% |

486 | 9% | Cell | 505 | 62% | Cell | 524 | 100% |

487 | 11% | Cell | 506 | 65% | Cell | 525 | 100% |

488 | 13% | Cell | 507 | 69% | Cell | 526 | 100% |

489 | 15% | Cell | 508 | 72% | Cell | 527 | 100% |

490 | 17% | Cell | 509 | 75% | Cell | 528 | 100% |

Test Eligibility Requirements: MCAT vs. CPA Exam

The MCAT and CPA Exam test requirements and registration process differ in many ways. However, these two exams utilize online registration through their official website.

The MCAT and CPA Exam have different test requirements since they do not have the same purpose. For example, the MCAT is a qualifying test for medical school admission, while the CPA Exam is a licensure exam for accountancy.

The comprehensive table below shows the differences between the MCAT and CPA exam with their respective test requirements.

MCAT Test Requirements | CPA Exam Requirements |

|---|---|

For Online Registration Process:

Present the following upon registration:

| Eligibility to Sit for the CPA Exam:

Online Registration Process: a. Visit and log in to Prometric website and register for the exam.

|

Test Costs: MCAT vs. CPA Exam

The CPA Exam fee significantly differs from MCAT. However, they share the same mode of payment.

One of the differences between these two exams is that the CPA Exam has three main fees: the application fee, registration fee, and exam fees for all four test sections.

The cost for the CPA exam application fee is USD 130 to USD 200, which is for the State Board of Accountancy, and it depends on what country you are going to take it. The application fee is required for those first-time takers.

Also, they have a registration fee of USD 300 and an examination fee of around USD 833.60.

Furthermore, the CPA Exam also has other additional fees, which consist of the Professional Ethics Exam Fee, which costs USD 169.

It also has a Licensing Fee of USD 175 and Continuing Professional Education Credits, costing USD 1,000 a year.

On the other hand, the MCAT only costs USD 325, which is cheaper than the CPA Exam. Also, the MCAT has a late registration fee of around USD 55.

Below is a comprehensive table showing the cost differences and payment options for the MCAT and CPA Exams.

MCAT Fee | CPA Exam Fee | |

|---|---|---|

Payment Modes |

|

|

Cost | USD 325 | USD 130 to USD 200 - Application Fee USD 300 - Registration Fee USD 833.60 - Examination Fee USD 169 - Professional Ethics Exam Fee USD 175 - Licensing Fee USD 1,000/year - Continuing Professional Education Credits |

Test Recognition: MCAT vs. CPA Exam

Both the MCAT and CPA Exam are highly regarded examinations worldwide.

In addition, the CPA Exam is offered in the United States, Canada, India, Nepal, England, Scotland, Ireland, Germany, Japan, South Korea, Brazil, Bahrain, Egypt, Jordan, Kuwait, Lebanon, the United Kingdom, Saudi Arabia, and Israel.

The AICPA, NASBA, and Prometric are the top administrators for the CPA Exam. And the collaboration of these three allows the CPA Exam available in most countries.

Moreover, the exam is prominent in the following countries such as the United States, Canada, Europe, Singapore, Australia, and the Caribbean Islands.

Below are some medical schools in Australia that require the MCAT.Below are some medical schools in Canada that require the MCAT.

Below are some medical schools in the USA that require the MCAT.

Average MCAT Score & GPA for Top 100 Medical Schools

MCAT Scores for Top Medical Schools & Universities in Canada

Which is Easier: MCAT vs. CPA Exam

The MCAT and CPA exam are two different tests that are internationally used and recognized by various educational institutions. In terms of their difficulty, both are known to be very challenging and difficult examinations.

Note that the MCAT is an admission exam, while the CPA exam is a licensure test.

Given their difference in terms of purpose, exam structure, topics covered, and more, we cannot truly compare their difficulty level.

Should You Take the MCAT vs. CPA Exam?

Before taking any of these two exams, you should know the purpose of these two and if it fits your needs.

For example, if you are already an accountancy graduate, then the suitable one for you is the CPA Exam for you to have a license to practice your profession.

And for those who want to pursue a medical profession and enroll in a medical school, the best exam for you to take is the MCAT.

Since the MCAT is part of the admission requirement in any medical school.

Summary Table of Differences: MCAT vs. CPA Exam

Below is the table of differences between the MCAT and CPA Exam.

MCAT | CPA Exam | |

|---|---|---|

Test Sections |

|

|

Test Duration | 7 hours and 33 minutes, including break times. | 16 hours |

Number of Test Questions | 230 Test Questions | 307 Test Questions |

Type of Test Questions | Multiple-Choice Test Format | Multiple-Choice Test Format Task-Based Simulations BEC Written Communications |

Scoring System | Score Range Per Test Section: 118 to 132 Overall Score Range: 472 to 528 | Score Range Per Test Section: 0 to 99 |

Test Frequency | 35 testing dates from January to September. | Offered four times a year (Per Test Section) |

Exam Cost | USD 325 | USD 130 to USD 200 - Application Fee USD 300 - Registration Fee USD 833.60 - Examination Fee USD 169 - Professional Ethics Exam Fee USD 175 - Licensing Fee USD 1,000/year - Continuing Professional Education Credits |

Mode of Payment | Only accepts credit or debit cards (American Express, VISA, MasterCard) | Accepts payments from credit and debit cards including VISA, MasterCard, and American Express. |

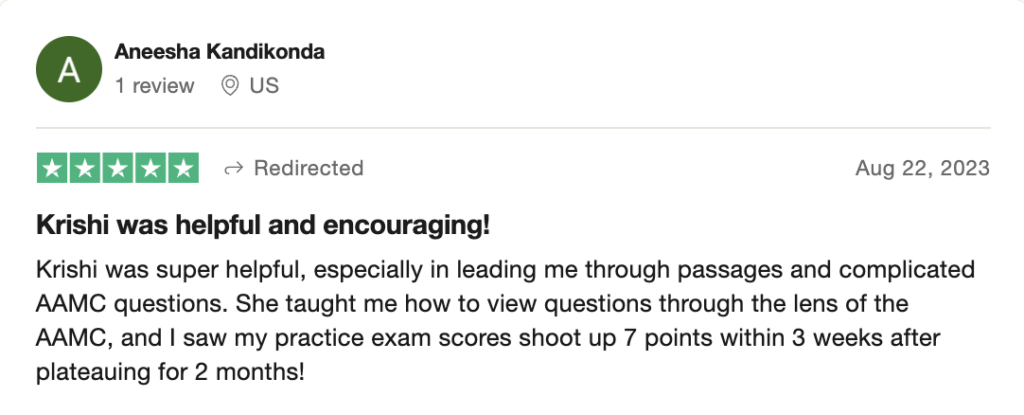

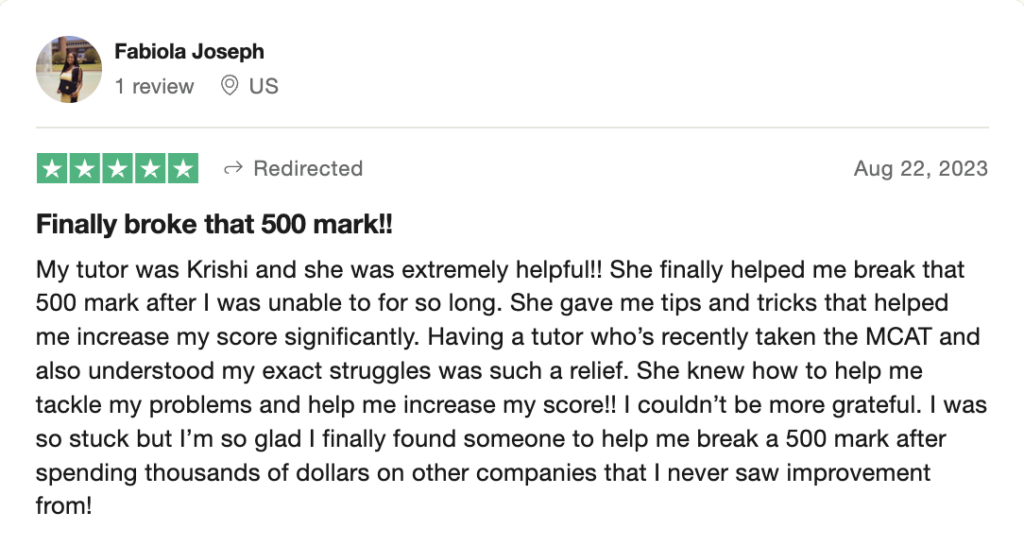

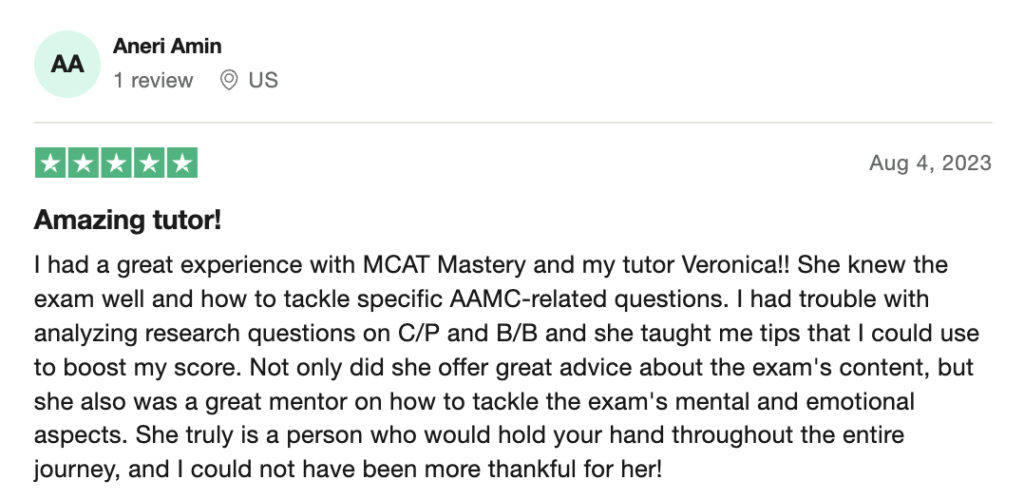

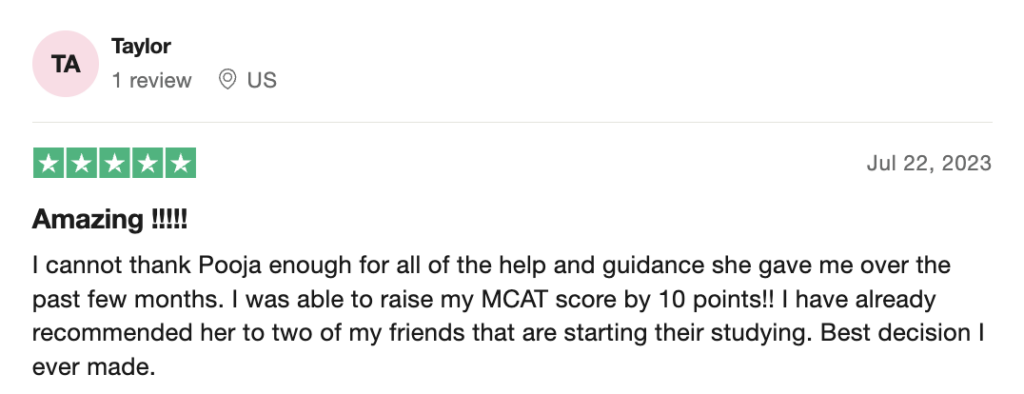

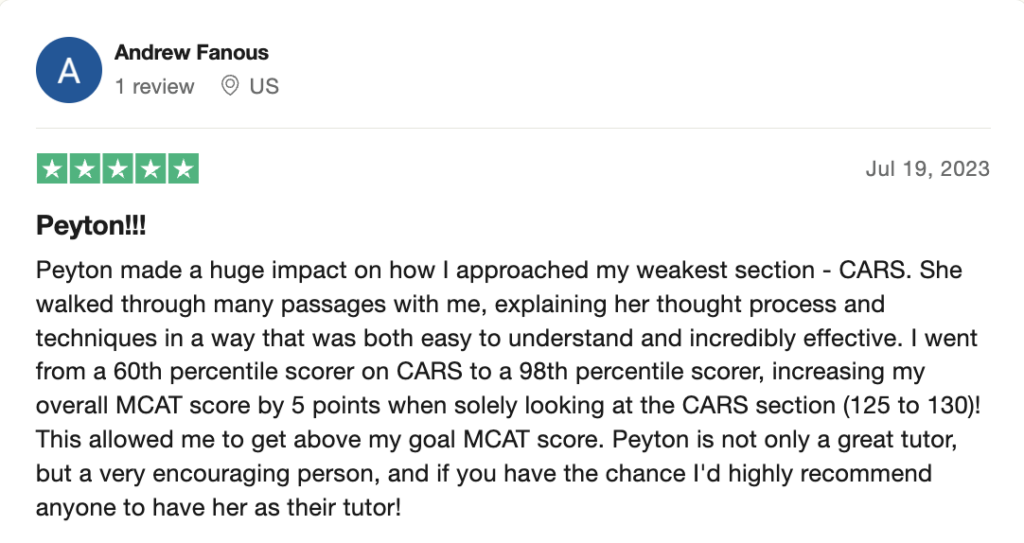

To help you achieve your goal MCAT score, we take turns hosting these

To help you achieve your goal MCAT score, we take turns hosting these